workers comp taxes for employers

It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury tendinitis or carpal tunnel. A credit of up to 54 percent may be allowed for state unemployment taxes paid for a normal net tax of 08 percent.

Fmla Vs Workers Compensation Rules What No One Tells You

In some cases the Social Security Administration SSA may reduce a persons SSDI or SSI so.

. The federal unemployment tax rate is 62 percent of the first 7000 in wages paid each employee. You retire due to your occupational sickness. For example if an employee earns 40000 of wages the entire 40000 is subject to the Social Security tax.

Workers compensation benefits are not normally considered taxable income at the state or federal level. In most cases they wont pay taxes on workers comp benefits. In the year 2022 the employers portion of the Social Security tax is 62 of the first 147000 of an employees annual wages and salary.

When Is Workers Compensation Taxable. For married filing separate returns the amount is increased to 5250 previously 2500. Federal Unemployment Taxes Employers generally are liable for both federal and Minnesota unemployment taxes.

Each days failure is a separate offense. The revenue from these fees goes to the state treasurer to be deposited in the Workers Compensation Administration Fund of which 30 per employee of the fee assessed against the employer reaches the Uninsured Employers Fund. Employers must register with the Taxation and Revenue Department in order to file the WC-1.

The following payments are not taxable. First understand that most of those receiving workers compensation benefits can exclude these payments from their annual tax returns. If you get the full credit your net FUTA tax rate would be just 06 42 plus whatever you owe to your state government.

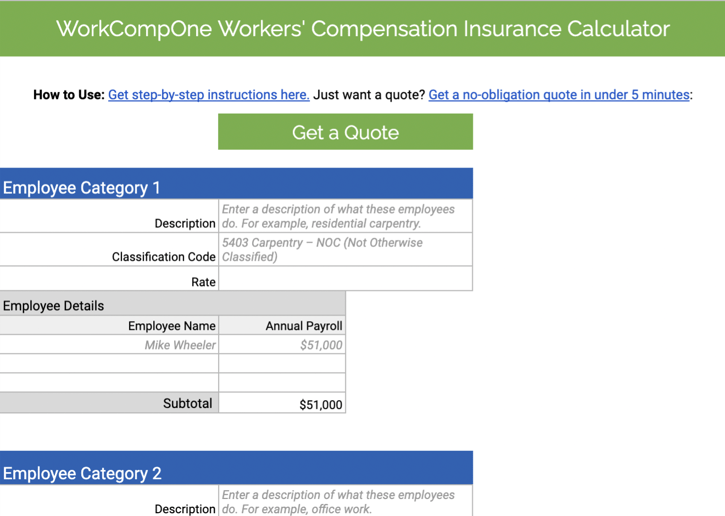

These Days Most Workers Compensation Insurance Premiums Look Like Payroll Taxes Whether you pay Ohio BWC KEMI or popular private carriers like Travelers or Liberty Mutual one thing that is common across the board for work comp insurance is that your insurance premium looks more like a payroll tax then an insurance bill. Independent contractors use 1099 and W9 forms for their labor. Sign into TurboTax Click on Take me to my return.

An employer who fails to obtain workers comp insurance is guilty of a misdemeanor and may be fined not more than 100000 or imprisoned for not more than 6 months or both. Employers can typically claim the full credit as long as their unemployment taxes are paid in full and on time. However there are a few notable exceptions where you may have to pay some taxes.

That means that your SSDI would be reduced by 400 to bring the combined benefits down to 80 of 2000 or 1600. Employee gross income is taxable to the employee including overtime pay for non-exempt employees and certain lower-income exempt employees. We get asked about situations where an employer has no workers comp insurance and remind people that it really does not.

Do You Have to Pay Taxes on Workers Comp Benefits. The IRS manual reads. Under the workers compensation system in almost every state in the US most employers are required to purchase insurance that provides a range of benefits to employees who are injured or become ill because of their jobs.

You are not subject to claiming workers comp on taxes because you need not pay tax on income from a workers compensation act or statute for an occupational injury or sickness. But theres another way. The simple answer is there is no such thing as a 1099 employee.

Workers compensation for occupational sickness or injury are not taxable if paid under a workers compensation act. In that case 400 of your monthly workers compensation benefits could be subject to tax if your total income is high enough. Small Shops 10 Employees No Employees.

Here are some more details. But you have a work around so you dont end up with increased taxable income. However retirement plan benefits are taxable if either of these apply.

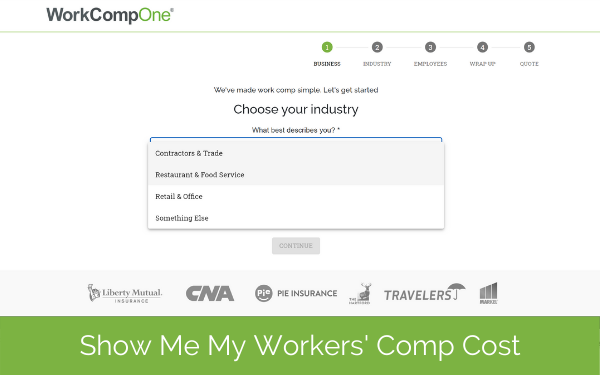

The quick answer is that generally workers compensation benefits are not taxable. We Know How To Fit Your Business. Workers compensation is typically one of those legally required employee benefits.

The American Rescue Plan Act of 2021 increased the maximum amount that can be excluded from an employees income through a dependent care assistance program. The lone exception arises when an individual also receives disability benefits through Social Security disability insurance SSDI or Supplemental Security Income SSI. Generally speaking workers comp benefits arent taxable at the state or federal levels for employees.

The W-2 will need to entered as it is because the IRS will be looking for that income. All payments your business makes to employees for work are taxable including salaries and wages including overtime. If youre injured at work and receive payments to cover your medical expenses loss of wages and painsuffering they arent taxable in most cases.

W2 employment is a typical 9-to-5 job and their employers withhold income taxes from their paychecks. Do you claim workers comp on taxes the answer is no. 7031 Koll Center Pkwy Pleasanton CA 94566.

If your pre-injury earnings were 1800 per month the combined benefits would be more than 80. Questions pertaining to Internal Revenue Service workers compensation issues may be directed to our Workers Compensation Center located in Richmond Virginia at 1-800-234-8323. Ad We Specialize In Small Biz Which Means We Make It Easy To Get The Right Coverage For You.

Generally speaking no workers comp settlements are not taxable at the federal or state level. However a portion of your workers comp benefits might be taxed if youre also receiving Social Security Disability Insurance SSDI benefits and part of those benefits have been offset by. If you have any questions regarding the employees work requirements please contact employees manager at telephone.

For 2021 the amount is increased to 10500 previously 5000. The system strikes a compromise between employers. If youre eligible for temporary disability payments or permanent disability benefits through workers compensation those benefits are generally tax-free at the state and federal level.

A W9 is for independent contractors to hand to their employer and a 1099 is what they get when they complete their work for the year. One of the silver linings of a workplace injury is state and federal taxes dont apply so theres no wincing as you look at your pay stub and see where Uncle Sam took 20 or 30 off the top. Tips commissions and fees benefits and stock options.

But like any tax situation there are exceptions to the rule you must know. An individual worker is either a W-2 employee or they are a 1099 Independent Contractor. Hence the employers amount is referred to as the matching amount.

Employees receive a W-2 from their employer each year and the employer pays taxes and benefits on their behalf.

5 Requirements For Workers Compensation Eligibility

What Is Pay As You Go Workers Comp

Workers Comp Is Never Off The Clock

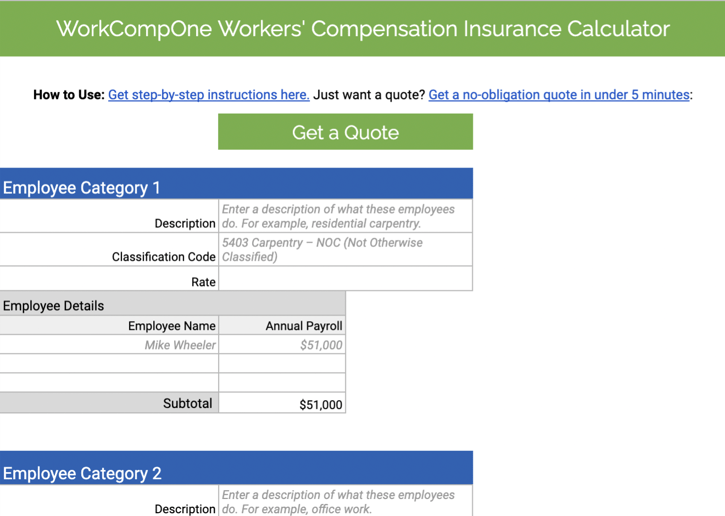

How To Calculate Workers Compensation Cost Per Employee

Is Workers Comp Taxable Workers Comp Taxes

How To Reduce Workers Compensation Insurance Costs Employers Resource

Workers Comp Vs Unemployment Benefits Foote Mielke Chavez O Neil

Workers Compensation Insurance Requirements Costs More

Are Workers Comp Benefits Adequate Legal Talk Network

What Wages Are Subject To Workers Comp Hourly Inc

Workers Compensation Insurance Overview Amtrust Financial

Ssd And Workers Compensation Benefits

Workers Compensation Insurance Cost Calculator How Much For A Small Business Policy

How To Calculate Workers Compensation Cost Per Employee Pie Insurance

Costratesadvisor Com Payroll Analysis Report Workers Comp Insurance Analysis Payroll Taxes

Get The Best Rates On Workers Compensation Insurance Workers Compensation Insurance Workers Comp Insurance Small Business Insurance

Fica Taxes Unemployment Insurance Workers Comp For Owners

With Hundreds Of Peos Offering Thousands Of Different Service Options We Ll Talk About Getting Company Benefits Workers Compensation Insurance Risk Management

How Much Does An Employee Cost Infographic Patriot Software Entrepreneur Business Plan Accounting Education Budget Help